11 Best virtual accounting jobs Hiring Now!

Contents:

We make sure accounts are well-managed and kept accurate and up-to-date for faster settlement. A lot of businesses lack knowledge of the prevailing tax system and run into complications when they have a bulk of tax applications to process and file. This burden is permanently mitigated by choosing our online accounting services. Our virtual accounting services are in demand, as we customize our solutions to meet the unique needs of every customer personally.

So, talk with your virtual accountant to see where they would like to improve and provide training when possible. Set Up Times for Check-Ins – Your virtual accountant is going to have questions. These inquiries could relate to the accounting system, a recent transaction, your expenses, or a more advanced accounting issue. Therefore, it is crucial that you set times throughout the week to meet with your virtual accountant and provide them with the information they need. If you are working with a variety of clients or have multiple sources of income, tracking them all can become difficult. A virtual accountant can help you organize these accounts and create detailed reports of all your income and expenses.

- Automatically create, populate, and post journals to your ERP based on your rules.

- Whether you’re new to F&A or an experienced professional, sometimes you need a refresher on common finance and accounting terms and their definitions.

- In the past few years, we learned that in-person meetings, and even working in the office is starting to become a thing of the past.

And, if your encumbrance accounting doesn’t have anyone taking on that accounting role otherwise, you are missing out on key financial direction and strategy that can streamline operations and find efficiencies. However, some virtual accountants choose to work on a retainer and accept checks and credit card payments. The working potential of a virtual assistant defines payment structure. While it is typically not in the virtual accountant’s scope to handle financial projections, they can provide still provide them. More advanced accounting will require professional firms that are better suited for this type of work. Three of the most critical key performance indicators are your cash flow statement, income statement, and cash disbursement schedule.

“Why should I hire a Virtual Assistant?” If you’ve asked yourself this question, it’s likely your business has expanded to… Receive job search tactics to find the best opportunities for you and tips for crafting your resume for remote-friendly employers. Best Billing and Invoicing Software for Small Businesses 2023 We weighed pricing, plans, features, reputation, and usability to find the best billing software for… We weighted each category equally to calculate our star ratings, and we also considered our accounting expert’s opinion and advice when ranking our top brands. Or, if you’re used to having coworkers, going out on your own can get lonely.

What Is Virtual Accounting?

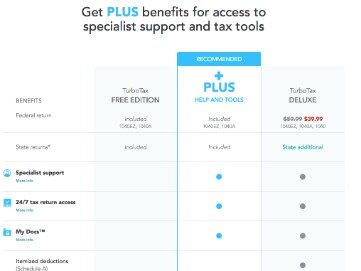

Prices start at $500 a month for the Essential plan, which is geared towards startups that use cash-basis accounting. Virtual and outsourced bookkeeping and accounting services are a happy medium between do-it-yourself software and pricey in-house bookkeeping. If that description fits what you’re looking for, one of the nine best virtual bookkeeping providers can save you time, money, and stress.

Ready to Rent: Checklist for Owning and Operating Residential … – Bob Vila

Ready to Rent: Checklist for Owning and Operating Residential ….

Posted: Fri, 21 Apr 2023 20:32:56 GMT [source]

Instead of settling for a less-experienced full-time employee, you can get the expertise you need at a fraction of the cost with a competent virtual accountant. Compared to hiring an in-person, in-house accountant, a virtual accountant costs less to get the same work done. They use their own tools and software, giving you the best of the best without requiring your company to invest in these financial resources.

Hourly payments – With the model of hourly fees, every hour spent working is billable for the virtual accountant. Here, you pay the hired virtual accounting assistant for each billable hour they worked towards the project. Provide Training – While accounting is relatively straightforward in practice, it never hurts to provide your virtual accountant with some additional training. They could pick up more efficient ways to organize documents, track spending, or even become well-versed in some financial analysis practices.

How to Choose a Small Business Bank Account

Our virtual accountants work flexibly and can fulfill your business’s specific requirements easily. You can outsource the entire accounting function or a few selected tasks. At the onset of the project, our virtual bookkeepers will sign Non-Disclosure agreements with you, so that you can be assured of complete data security and confidentiality. Your company can increase its productivity and profitability in the long run by opting for virtual accounting. It can benefit your overall business in time, technology, labor, and productivity.

Chennai-based accounting firm under scanner for forging documents – The Hindu

Chennai-based accounting firm under scanner for forging documents.

Posted: Fri, 24 Mar 2023 07:00:00 GMT [source]

Your recruitment becomes solely based on skills fit and not the geographical fit. This ensures that you attract the best talent available for your firm. Both accountants and bookkeepers can be virtual, but they do different things. While both can help you manage the ins and outs of business finances, bookkeepers are not trained in higher-level, complex financial tasks. Accountants generally have more familiarity with applying these numbers to business decisions, such as flux analysis, budget vs actuals reporting, or cost accounting. While virtual accountants provide the same services as traditional accountants, they can also work for small businesses and individuals.

Factors determining the Cost of a Virtual Accounting

Integrate with treasury systems to facilitate and streamline netting, settlement, and clearing to optimize working capital. Streamline and automate intercompany transaction netting and settlement to ensure cash precision. When it comes to sharing sensitive or confidential documents online, many people feel apprehensive. They worry that their files might not be secure and that anyone could access them if they’re not careful.

Transform your accounts receivable processes with intelligent AR automation that delivers value across your business. All in all, if the pandemic has proven anything, it’s that remote work is here to stay. Technological advances in both video chatting and cyber security has allowed my introduction to offering virtual services become natural and effortless. We provide accounting services that surpass your expectations while helping you improve operational efficiency and overall business profitability.

Organize your bank statements through your virtual bookkeeping service. Ask another business owner if there’s a bookkeeping service they recommend or if there’s a virtual bookkeeping service they should avoid. The total startup costs for virtual bookkeeping are a fraction of the costs of setting up a brick-and-mortar business. Many virtual accountants have a dedicated home office, but their office can be anywhere they have a laptop or mobile device and an internet connection. All accounting and tax services for individuals and families that we provide in person are also offered virtually. We specialize in service-based businesses but have a few industry specializations.

Save on Employee Costs

Derek Gallimore has been in business for 20 years, outsourcing for over eight years, and has been living in Manila since 2014. Derek is the founder and CEO of Outsource Accelerator, and is regarded as a leading expert on all things outsourcing. The Outsource Accelerator website has over 4,000 articles, 250+ podcast episodes, and a comprehensive directory with 2,300+ BPOs… All designed to make it easier for clients to learn about, and engage with, outsourcing.

Your virtual accountant can adjust to changes in work volume, especially in busy seasons of your business where there is an increase in transactions or complexity of work. Whether you’re new to F&A or an experienced professional, sometimes you need a refresher on common finance and accounting terms and their definitions. BlackLine’s glossary provides descriptions for industry words and phrases, answers to frequently asked questions, and links to additional resources. To truly transform your finance and accounting processes, you need the guidance of a trusted partner. Our proven approach has helped thousands of customers identify and address bottlenecks to free up capacity, strengthen controls, and deliver measurable results. Global brands and the fastest growing companies run Oracle and choose BlackLine to accelerate digital transformation.

How Can CFO Strategies Help Your Company With Virtual Accounting Services?

The revenue cycle refers to the entirety of a company’s ordering process from the time an order is placed until an invoice is paid and settled. The inability to apply payments on time and accurately can not only lock up cash, but also negatively impact future sales and the overall customer experience. Timely, reliable data is critical for decision-making and reporting throughout the M&A lifecycle. Without accurate information, organizations risk making poor business decisions, paying too much, issuing inaccurate financial statements, and other errors.

What Will It Cost to Hire a Virtual Accountant In 2023? – BOSS Magazine

What Will It Cost to Hire a Virtual Accountant In 2023?.

Posted: Mon, 27 Feb 2023 08:00:00 GMT [source]

If you are a CPA and are interested in joining CPA MOMS to work in a flexible, virtual environment, access our job board to find a position that allows you to raise your kids and have a career. Wealth & Finance is committed to providing its audience with the latest information on up-to-date market trends and advice on all things related to finance and fund management. Our experts are ready to talk to you today on how Finvisor can stream your operations by working virtually. Chartered Global Management Accountants usually work in business and government, and Enrolled Agents deal with the Internal Revenue Service and taxes.

It makes all your documents available online and enables all your remote and full-time employees to work on the same projects or accounting records or report anywhere worldwide. This available data in a digital format can also easily be used in annual reports of your business. They can help shareholders better understand the company’s financial progress over time.

We also have command over payroll services wherein you can offshore all of your payroll activities to us and let us manage everything within the payroll domain with accuracy. We handle tax calculation, payroll accounting, payslip generation, accounting, direct deposit, and pay calculation among other nitty-gritty to save time and effort. Virtual accounting comes with higher data security as all your accounting records and reports have a backup and are well-protected in cloud computing. This prevents any data losses for your company due to natural disasters, theft, or internal data breaches.

A virtual accountant should be a qualified accounting professional, capable of doing anything a conventional accountant can do. Services might include corporate tax filing, bookkeeping, reconciliation of accounts, processing payroll, accounts payable, and even CFO services. A virtual accountant is an expert that provides bookkeeping services, payroll services, and other accounting-related tasks.

To be clear, we’re happy to meet with clients in person, and you don’t have to choose between virtual and face-to-face meetings. You might choose, for example, to meet in person once a year and meet virtually once a quarter. We’re happy to provide that flexibility because it allows us to build strong relationships and deliver the kind of personal service you deserve from your accountant. Book a free, 60-minute discovery call, where we can discuss your goals, where your business currently stands, the level of support you need and offer customized tiered solutions with pricing. Should we both decide that it would be a good fit working together, we will send a proposal for signature and begin the onboarding process. Historic virtual Accounting services include one meeting per month to review financials and YTD including budget to actuals .

Working capital, cash flows, collections opportunities, and other critical metrics depend on timely and accurate processes. Ensure services revenue has been accurately recorded and related payments are reflected properly on the balance sheet. To sustain timely performance of daily activities, banking and financial services organizations are turning to modern accounting and finance practices. Cogneesol provides you with access to talented professionals having the required accounting expertise to handle your business accounting.